My College Story

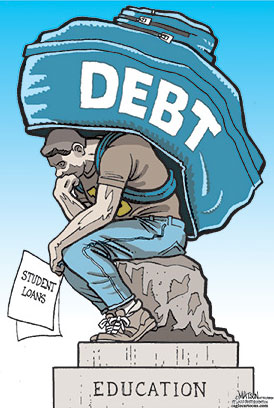

From my own personal experience, I felt I had to go to college even if I didn't know what I wanted to do at the time. Many students go about attending school this way, hoping they find some inspiration at some point along the way. I admittedly made some mistakes in college - not thinking enough about my financial future was one of the biggest. I ended up coming out of college with just over $40,000 in debt, and the only jobs available were for minimum wage.

From my own personal experience, I felt I had to go to college even if I didn't know what I wanted to do at the time. Many students go about attending school this way, hoping they find some inspiration at some point along the way. I admittedly made some mistakes in college - not thinking enough about my financial future was one of the biggest. I ended up coming out of college with just over $40,000 in debt, and the only jobs available were for minimum wage.As I must take responsibility for my actions, I believe that too little was done on the part of the university I attended and the student loan companies I borrowed from. I believe that all students in their junior and senior years should receive financial literacy training, and much more guidance needs to be given to these young people before they potentially sign their financial lives away. The need for this is the greatest right now, as our economy is much worse off than it was in 2005. Millions of graduates young and old are struggling to get by because of their student loan debt.

Student Loan Justice

My experiences with higher education and the student loan industry lead me to start investigating more into the subject, and what I found was very concerning. I read stories about predatory lending, Sallie Mae giving bribes to financial aid offices to sell their loans, and many stories of people being crushed by their debt. I ended up finding a group called Student Loan Justice, which is a grassroots organization devoted to restoring standard consumer protections to student loans. The founder, Alan Collinge, lays out a clear and compelling argument for reform while providing evidence of corruption and scandal by the student loan industry. This argument is supported by the thousands of stories of hardship that have been submitted to the site.

I decided to take the lead here in Maine and represent these people, as there was no existing voice for them. It gave me experience in grassroots organizing, information gathering, and public relations. The biggest fruit from the venture came back in March of this year, when I appeared on Maine Watch with Jennifer Rooks armed with the stories of local people struggling to get by because of their student loans. I appeared alongside Elizabeth Bordowitz, CEO of the Financial Authority of Maine (FAME).

I decided to take the lead here in Maine and represent these people, as there was no existing voice for them. It gave me experience in grassroots organizing, information gathering, and public relations. The biggest fruit from the venture came back in March of this year, when I appeared on Maine Watch with Jennifer Rooks armed with the stories of local people struggling to get by because of their student loans. I appeared alongside Elizabeth Bordowitz, CEO of the Financial Authority of Maine (FAME).Please be an informed citizen and research the topic. You can also visit StudentLoanJustice.org, and view the show that aired on March 27, 2009 on MPBN.net.

No comments:

Post a Comment